Contact Your NewwaySMTC Representative Now! [email protected]

Demand for refinement gives rise to high-speed development of thin carrier tape market

Thin Carrier Tape Market Development Status and Trends Analysis 2022 can be seen that the demand for refinement has given rise to the thin carrier tape market is growing at a rapid pace.

The demand for miniaturization and refinement of electronic components has given rise to the thin carrier tape market

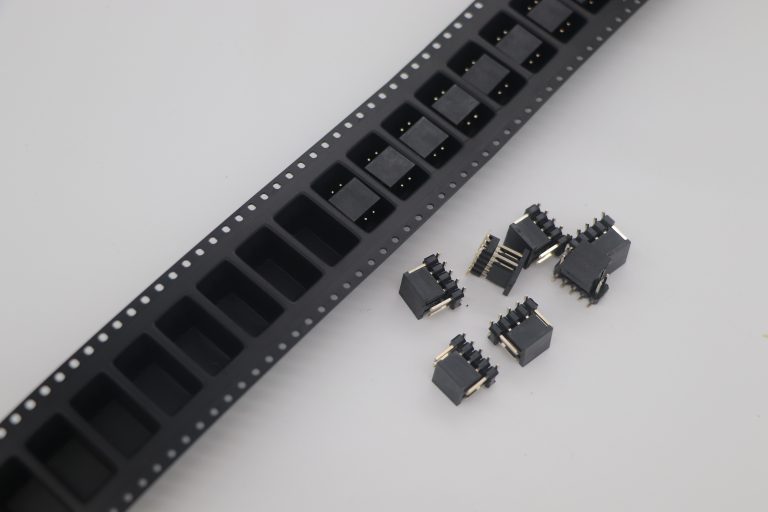

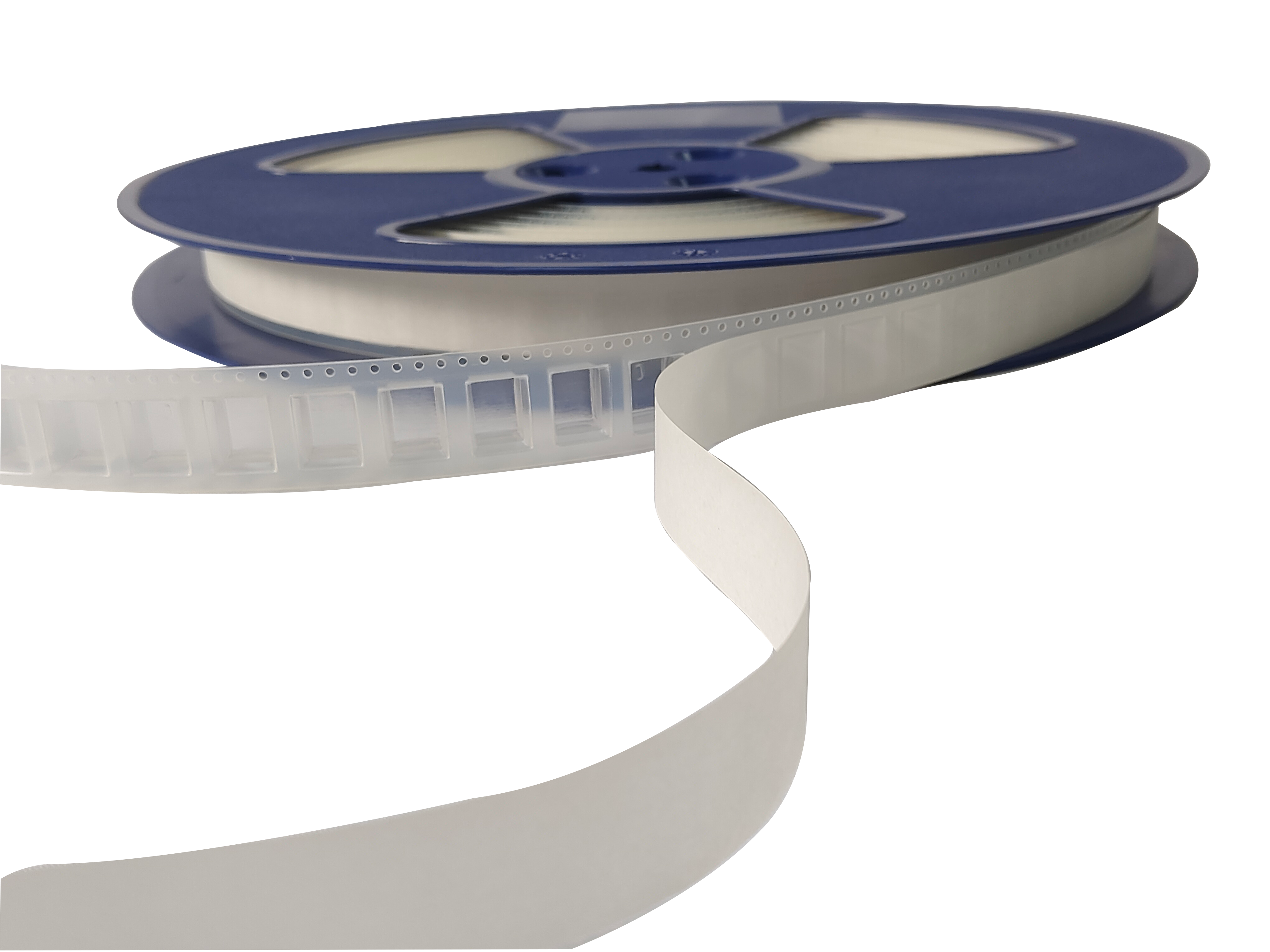

Thin carrier tape has two main functions: protection transfer and SMD positioning. Carrier Tape is a strip product used in the field of electronic packaging, it has a specific thickness, in the direction of its length is equidistantly distributed for the placement of electronic components cavities and positioning holes for index positioning. The cavities seal the electronic components inside the tape by matching the upper and lower sealing tapes, while the positioning holes facilitate the automated mechanical operation of electronic component placement. In addition, the carrier tape provides additional functions such as anti-static and anti-corrosion. Therefore, the thin carrier tape plays a basic and important role in the process of surface mount technology (SMT), and is an important carrier and consumable part of the surface mount technology of electronic components, and its product quality directly determines the packaging performance of electronic components.

SMT and chip components each other and together open the demand of thin carrier tape

Chip components are tiny components without leads or short leads, which are special components of surface mount technology (SMT). It has the advantages of small size, high mounting density, high reliability, and good high frequency characteristics. In addition to the chip component appearance with standardization, series and welding conditions of consistency, friendly to the automated processing process, superimposed on the birth of advanced high-speed placement machine, so that the surface mount (SMT) production efficiency continues to improve.

Most PCBs are now using this low-cost, high-productivity, reduced-volume PCB production technology, which has led to the development of chip-type components, replacing the original jack-type components. In addition, the demand for smaller and more versatile 3C products has further boosted the demand for highly integrated and miniaturized chip components, which also drives the demand for thin electronic carriers as their carriers and positioning bases.

Electronic components is a collective term for electronic components and electronic devices, and the global electronic components market is growing significantly. According to Globenewswire data, the global general-purpose electronic components market will grow from $337.12 billion in 2020 to $378.68 billion in 2021, a 12.3% year-over-year increase. And the market is expected to reach $509.06 billion by 2025, growing at a CAGR of 8%. For electronic devices, semiconductor devices, for example, according to IC Insight data, global semiconductor shipments will reach 1,135.3 billion units in 2021, yoy13.36%.

Paper carrier tape is commonly used for component packaging, and plastic carrier tape is commonly used for device packaging

Compared with electronic components represented by semiconductor discrete devices, integrated circuits, and LEDs, the former are usually smaller and thinner, so paper carrier tape is mostly used for packaging electronic components, while plastic carrier tape is used for packaging electronic devices represented by semiconductor discrete devices, integrated circuits, and LEDs.

Through the output and spacing of components and devices, we can project the domestic market space of paper carrier tape: the market space of paper carrier tape in 2020 is about 1.4 billion yuan. Electronic components in the surface mount corresponds to an aperture on the carrier tape, and there is a certain amount of relationship between the two.

Plastic carrier tape market space in 2020 is about 2.5 billion yuan

The spacing between two apertures on plastic carrier tape is wide, there are 4mm, 6mm, 8mm, 12mm, 24mm, etc. Considering the trend of small size of components, the spacing is 8mm. based on the output of about 1,965.32 billion pieces of semiconductor discrete devices, integrated circuits, LED, etc. in 2020, the corresponding plastic carrier tape is 15.723 billion meters. The price difference between high and low end products of plastic carrier tape is large, we take the selling price of 0.16 yuan/meter, then the domestic market size is about 2.516 billion yuan in 2020.

Plastic carrier tape is optimized to replicate the experience of paper carrier tape and realize the breakthrough of high-end market by self-production of raw materials

The company’s leading position in the field of paper carrier tape is solid

The company has responded to the downstream demand and expanded production at a fast pace. 2021 saw a large-scale expansion of production, with the construction of a new packaging tape expansion project completed and a combined capacity of 4.2 million rolls/year after commissioning. As for plastic carrier tape, the technical transformation project of the production line of 1.5 billion meters per year of plastic carrier tape for electronic components packaging is expected to reach the scheduled availability on December 31, 2021.

The company has achieved self-production and self-supply of raw materials for the main products of thin carrier tape

The performance of raw materials has an important impact on the surface mounting effect of electronic components, which requires mastering many key technologies and processes and participating in many rounds of demanding customer certifications. The direct material of the carrier tape is the main production cost, and the direct material is self-produced to reduce cost and increase efficiency. Taking paper carrier tape as an example, the company has now achieved self-production of raw paper, and the proportion of purchased electronic raw paper accounts for about 5%-10% of the total consumption of raw paper each year. The mismatched pricing in the plastic carrier field gives the company a better environment for growth. The domestic plastic carrier tape market is still fragmented, similar to the paper carrier tape market when the company started, but we believe that plastic carrier tape raw materials are not only more expensive and technologically advanced, but also have pricing distortions, making it a better environment for the company to grow.

In addition, the company further reduces direct material costs by reusing scrap generated from cutting, punching and hole-pressing processes. We believe that the gross margin of paper carrier tape has room for improvement as the revenue share of pressed and perforated paper carrier tape gradually increases.